CEST and BuildingMinds Launch Global White Paper to Advance ESG-Driven Energy Storage for Leading Asset Owners

CEST and BuildingMinds Launch Global White Paper to Advance ESG-Driven Energy Storage for Leading Asset Owners

Chongqing, China – [18 July, 2025] – Standard Energy (CEST), in strategic partnership with BuildingMinds, has launched a new global white paper titled “Enhancing Sustainability and Reducing Risks for Asset Owners.” This jointly authored report explores how smart energy storage and digital infrastructure can support the world’s leading real estate and industrial asset owners in achieving their ESG, cost optimization, and resilience goals.

The white paper is based on deployment results from the Standard Energy Industrial Park, where Standard Energy's (CEST) integrated PV-storage-charging system achieved 38% energy cost reduction, 62% carbon emission reduction, and 99.9% blackout risk mitigation. These outcomes reflect a growing demand among global portfolios for solutions that deliver both operational value and regulatory compliance.

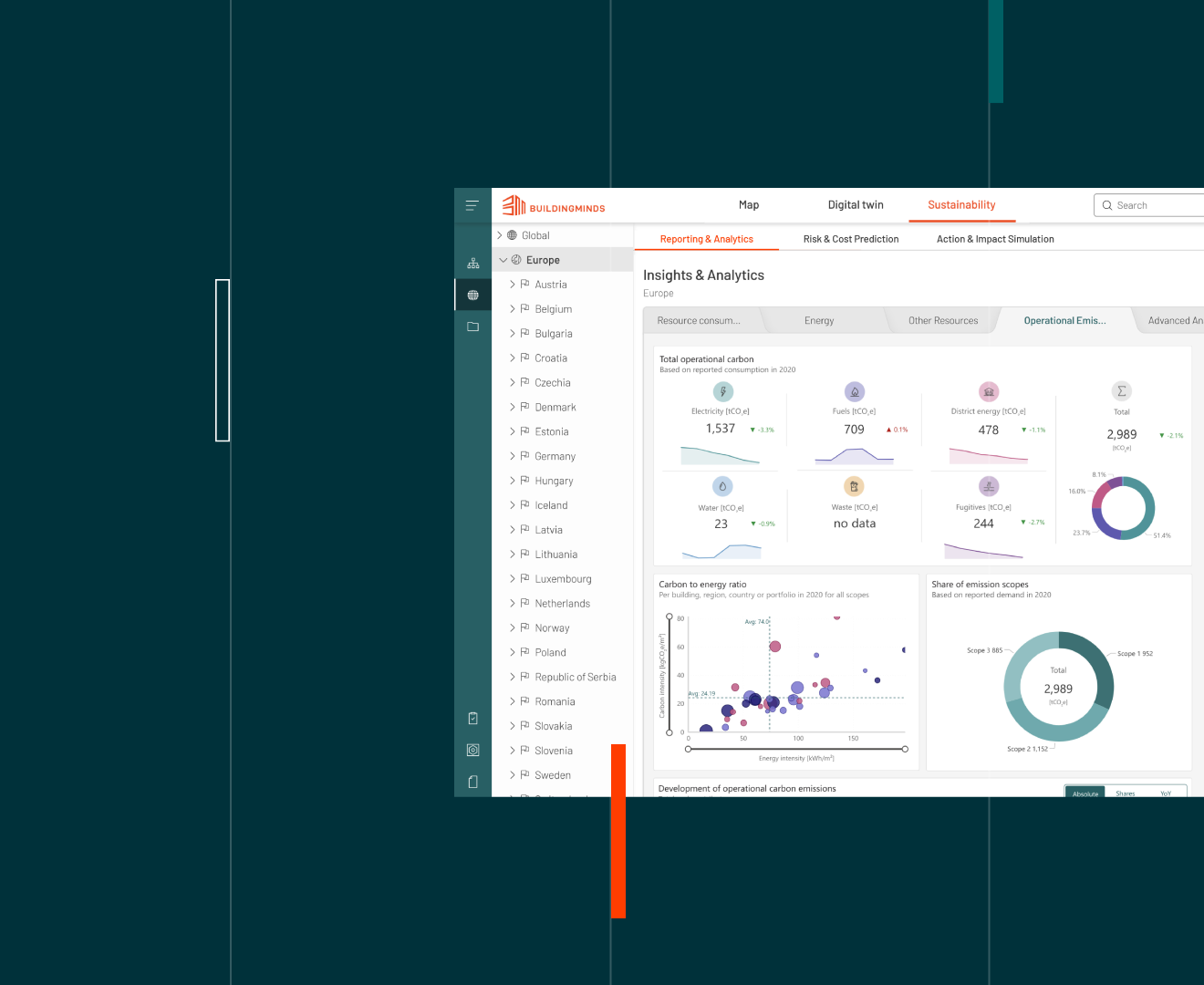

BuildingMinds, a Schindler backed platform, is recognized globally for helping asset owners centralize ESG data, automate reporting (CSRD, SFDR, GRESB), and align capital planning with net-zero objectives across portfolios.

“As asset owners face rising ESG disclosure demands, they need solutions that go beyond compliance to create measurable value. This white paper demonstrates how the fusion of physical energy systems with digital intelligence can unlock both sustainability and financial outcomes,” said Marek Sacha, CEO of BuildingMinds.

Key Findings from white paper:

· 93% total system efficiency, vs. 85% industry average

· ≤15 ms response time for energy backup

· 23% annual peak-valley arbitrage yield

· 11% IRR, exceeding industry benchmark

· 750 tons of carbon reduction per year

· 40% increase in client benefits through cost, carbon, and downtime reductions

The white paper discusses diagnostics and revenue forecasting tools for asset managers and industrial operators aiming to comply with EU CBAM and global ESG frameworks.

Download the white paper here: