Resilient Real Estate

Risk, cost and resiliency data management

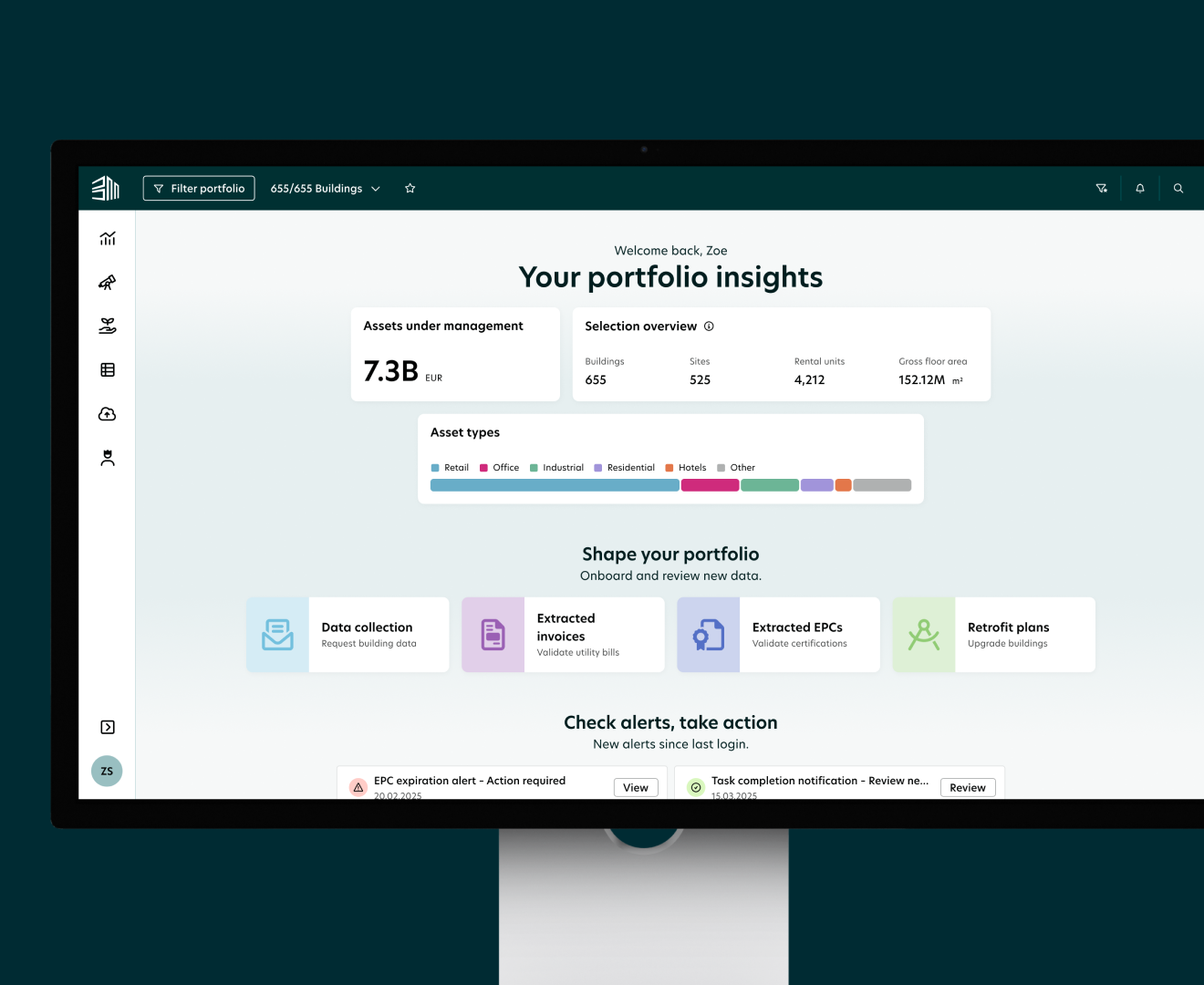

BuildingMinds meets the needs of real estate professionals across the value chain, providing building or unit-level data flows to enable reporting, risk and profitability outputs while accounting for interdependencies related to portfolio management.

The single source of truth for all asset and portfolio data

Risk management starts with clarity

Predict physical risk to build strategies for managing climate expected loss and understand potential market risk related to stranded assets by calculating GHG impact and cost associated carbon emissions.

Assurance-ready reporting data to clear regulatory hurdles

Tackle reporting and compliance requirements efficiently and accurately with data fed through the BuildingMinds platform, a secure, single source for data needed for regulatory reporting pertaining to GHG emissions and energy efficiency standards.

Optimize for financial gains

Get the visibility needed to increase net-operating-income (NOI) while reducing energy consumption. Leverage machine learning-based retrofit recommendations, provide CapEx and saving estimations. Explore algorithm-driven energy consumption projections.

Trusted by

Protect valuation

From insights to actions. Drive your decarbonization targets and increase your net-operating-income (NOI):

- Machine learning-based retrofit recommendations provide CapEx and saving estimations for secure capital planning.

- Smart automated data collection of energy, resources and emissions monitoring. Data gap estimation and plausibility checks for higher data quality.

- Increase asset value by lowering energy expenses through our utility monitoring system, proactively calculate future carbon taxes, and stay ahead of potential carbon costs that may impact your investments.

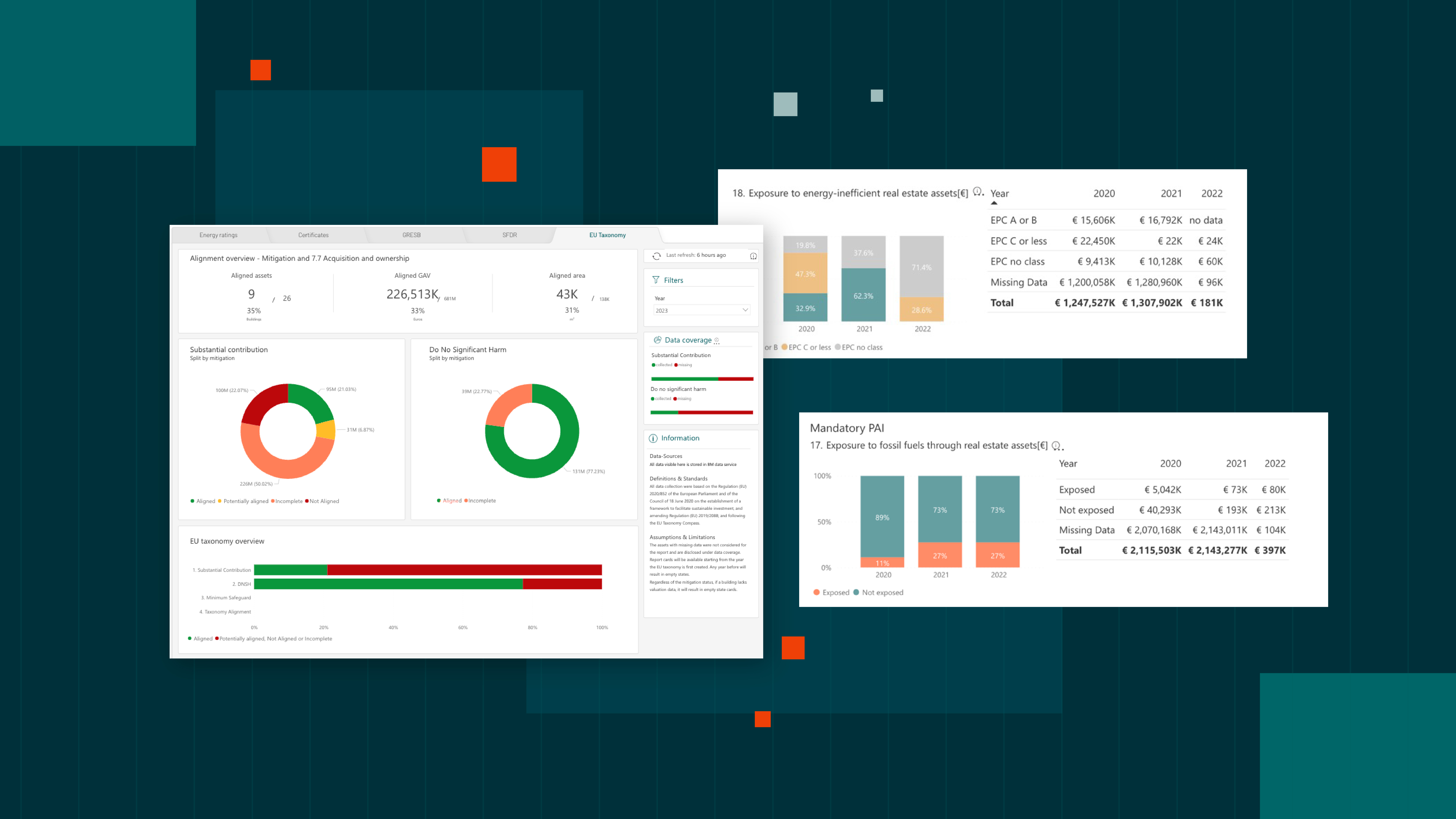

Clear regulatory hurdles

Tackle reporting and compliance requirements with data feed through the BuildingMinds platform, a secure, single source of truth for data required for regulatory reporting:

- Easy reporting for international regulations and reports such as GRESB, Energy Star, EU Taxonomy, SFDR, CSRD and more.

- Data snapshots and change logs for assurance- or audit-ready data.

- Accelerated reporting with BuildingMinds’ GRESB data quality dashboard, featuring API integration with the GRESB portal. Visualizations simplify and streamline the reporting process for improved scores.

De-risk your portfolio

Future-proof your portfolio and safeguard its value by understanding financial, physical and stranding risks.

- Follow the Carbon Risk Real Estate Monitor’s (CRREM) framework to decarbonization in accordance with the Paris Agreement. Avoid stranding risk and calculate the impact of retrofits.

- Predict physical risk across portfolio geographics. Apply risk, hazard and climate hazard scores established by our partner Munich RE.

- Merge the physical and the digital with a Digital Building Twin to manage and analyse building performance.

Our platform is designed to safeguard the value of your portfolio

Hassle-free data management

Simplified data collection through APIs. Improved data quality and completeness through plausibility checks, data gap estimation and anomaly detection.

Taxonomy alignment assessment

Workflows with data populated from the digital twin to assess Taxonomy alignment, including adaptation and mitigation criteria.

GRESB reporting

With a direct API integration to GRESB, we support preparation of all quantitative inputs. Easy visualization of data gaps can help improve scoring.

Retrofit recommender

Automated estimation of retrofit investment costs and energy savings. Optimal retrofit results with the help of machine learning-trained data sets.

Advanced energy management

See energy consumption across any relevant utilities for a building and take it one step further: leverage an algorithm adapted the profile of a building to predict future consumption.

Data coverage

Be more effective in preparing for GRESB and other critical assessments by understanding the composition of the full portfolio of data.

Together with BuildingMinds, we are leveraging the power of ESG data to realize effective emission reductions through data modelling and reduction scenario analytics.

A platform that puts you in full control of your data

Data Ingestion and Management

Eliminate manual data entry across your portfolio. BuildingMinds automates data collection from invoices, certificates, and smart meters, delivering accurate, complete, audit-ready data for ESG compliance.

- Data collection and extraction

- Portfolio and building management

- Data quality and monitoring

Reporting, Benchmarking and Risk

BuildingMinds makes it easy to generate reports for GHG, GRESB, SFDR, EU Taxonomy and more. Our platform calculates your operational emissions, analyzes resource consumption, and assesses your portfolio's exposure to carbon and climate risks – all from a single source of truth.

- Resource consumption & emissions analytics

- ESG reporting

Decarbonisation Investment Planning

Analyze your emissions, identify which assets to retrofit and when, and simulate the impact of scenarios and planned measures. Our solutions help you optimize your decarbonization strategy to turbocharge the performance of your assets within your CapEx budget.

- Retrofit planning and prioritisation

- Impact Measurement & Tenant Engagement